2024.06.04 Weekly

A late and woozy start to the week from my brief trip back to Hong Kong which is also very much like the cross asset action we’ve seen in recent sessions. 2 main thoughts on the risk complex — while I think 1) gains may be hard to come by or even stick when they do come, it will 2) be just as equally difficult to sell-off meaningfully.

Earnings watch

12 month forward EPS continued higher to 12.344% as of May 23rd, which

is the highest pace of earnings growth expectations since October of 2021.

For small-caps, expectations eased off in recent weeks but well off the early March trough. If there are concerns about an impending economic slump, equity markets certainly aren’t buying it yet.

Economic data watch

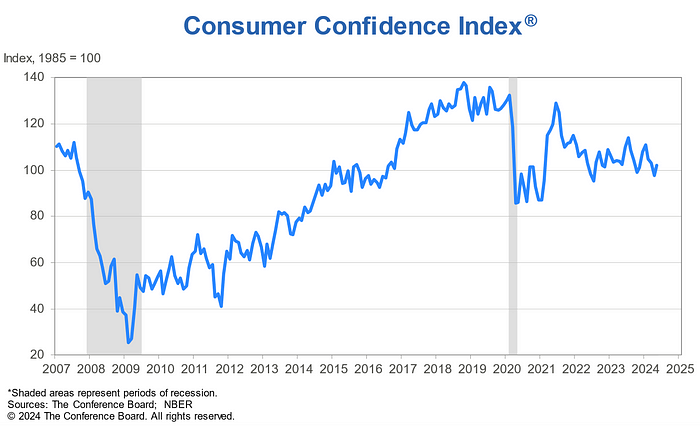

A lot of focus on the health of the Consumer economy with some evidence creeping through that consumer demand has peaked. Conference Boards initial survey data showed a rebound in consumer confidence.

That rebound was based on a less pessimistic 6mo+ outlook in business and labour market conditions, with a big improvement future income prospects. This is quite a positive shift in consumer sentiment despite what we’ve seen in Retail sector earnings reports and slowing Retail sales data.

What doesn’t add up to the above is the “perceived likelihood of a US recession over the next 12 months” — more consumers thought a recession was more likely for the 2nd month to the highest since last October.

Monthly rate of core PCE inflation came in at 0.2% missing market expectations of 0.3%. Un-rounded, m/m core was 0.249% which may not be something to get overly excited about as I think it is safe to assume market estimates were closer to 0.25% than 0.3%.

Nevertheless, core inflation easing is a big positive and the importance should not be understated. Early 2024, inflation reaccelerating was the big concern for the fed and markets (which was largely unfazed as data and earnings have held up); now, it’s becoming apparent the inflation-spurt could be blip and is back on track in view of the Fed. Shorter-term annualised inflation is still around 3% however but for now, the market can relax a bit on stagflation concerns.

Looking ahead, Cleveland Fed nowcast projects softer inflation prints after m/m CPI of 0.4% in March, 0.3% in April, to around 0.1% prints over the next 2 prints.

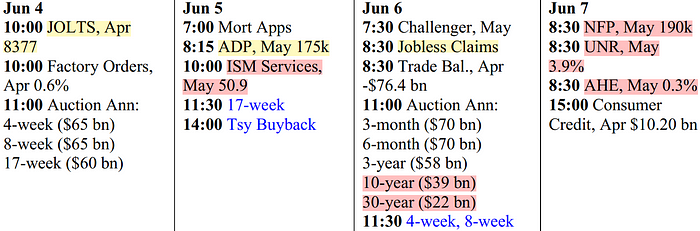

Looking ahead we have Jobs data and ISM Services as well as 10 and 30yr auctions. The trend in jobs data has pointed to resilience amid gradual loosening and if this week’s data continues to point in that direction, that will be risk positive. ISM prices paid saw a big jump in April from 53.4 to 59.2 last time round and that will be risk positive if that proves to have been a one-off spurt. Demand for Treasuries has been solid recently so I expect no fireworks there.

Overall, economic data is pointing in the right direction — cooling yes but resilient enough not to show significant cracks yet. In other words, while the data might give the bears something to chew on, it’s still early and for me, has yet to give me reason to take a less optimistic view nor any reason to start taking a pessimistic one. This market is still very reactive to data/policy (i.e. bad news is good news), and that keeps me broadly constructive the risk complex holds up.

NEWSFLOW

MARKETS

- S&P 500 enters June near a record but with growing concerns about the market’s narrow leadership (CNBC). Chinese Stock Rebound Sparks Rush of Firms to Raise Funds (BBG). Global equity funds record first outflows in five weeks amid rising U.S. yields (RTS). Traders Push Treasuries Higher as Data Reinforces Fed Cut Bets (BBG). Ed Yardeni Sees Less 2024 Equity Upside as Reality Bites — ‘We are still in a bull market, but it will be slowing down from here,’ he says (BBG).

- Wall Street shifts to faster settlements; bumps seen ahead — U.S. trading on Tuesday moved to a shorter settlement cycle for securities transactions, putting investors and regulators on alert for increased trade failures (RTS). The SEC ruling on Ethereum ETFs could mark a historic shift in crypto investing (CNBC). Bitcoin Tests $70,000. What the Crypto Needs to Break Through — Bitcoin briefly passed $70,000 as fresh data pointed to a slowing U.S. economy and pushed down yields on Treasury bonds (Barrons).

- Oil alliance OPEC+ extends collective crude production cuts into 2025 (CNBC). Oil hits four-month low as OPEC+ decision fails to allay demand worries (RTS). US oil futures draw renewed interest from hedge funds — Portfolio investors purchased petroleum contracts for the first time in seven weeks as traders squared up short positions ahead of the OPEC meeting (RTS). Norway outage pushes European gas prices to highest this year (RTS). Europe gas supply risks ease as key Norway pipeline due back Friday (RTS). Copper Falls Through $10,000 as Exchange Inventories Keep Rising (BBG). Funds keep faith with copper even as squeeze fades (RTS). Red Sea diversions, tariff risks send ocean shipping soaring (RTS).

AMERICAS

- The Fed’s preferred inflation measure rose 0.2% in April, as expected — increased 0.2% in April and 2.8% from a year ago, Headline PCE rose 0.3% and 2.7% respectively (CNBC). Price cuts, weaker spending could bolster Fed’s faith in inflation outlook (RTS). Fed Likely to Seek More Evidence Despite Cooler Inflation Data (BBG). US consumer confidence recovers; inflation worries persist — Consumer confidence index rises to 102, Labor market differential widens to 24 from 22.9, House price increase slows in March (RTS). Pending home sales in April slump to lowest level since the start of the pandemic (CNBC). Bank of America CEO says U.S. consumers and businesses have turned cautious on spending (CNBC). Hiring Pace for Low-Income Workers Still Robust, Vanguard Says — Data show US hires rate in April climbed to 18-month high, Higher-paying industries more cautious in hiring: economist (BBG). Donald Trump Found Guilty on All 34 Counts in New York Hush-Money Case — He is the first former president to be found guilty of a crime (WSJ). Billionaires rallying behind Trump after his conviction (BBC).

- Canada June rate cut bets rise after first-quarter GDP miss (RTS). Mexico elects Claudia Sheinbaum as first female president (BBC).

EUROPE

- UK shop price growth back to normal, retailers say — Prices in British shops rose at the slowest pace in 2–1/2 years this month, BRC said retail inflation was back to normal after its surge (RTS).

- Euro zone inflation rises to 2.6% in May, but bloc still seen heading for interest rate cut (CNBC). ECB has room to cut rates but should take its time, policymakers say (RTS). ECB revamps its annual health checks on banks (RTS). German business sentiment stagnates in May — IFO business climate index remained constant in May at 89.3 vs 90.4 expected (RTS). Euro zone consumers lower inflation expectation, ECB survey shows (RTS).

ASIA

- China’s new home prices inch up for 9th month in May, survey shows (RTS). China’s Biggest Cities See Housing Market Pick Up After Easing — Shanghai, Shenzhen buyers show interest in new and used homes, Analysts, investors are optimistic worst of slump may be over (BBG). China’s industrial profits rise 4.3% in Jan-April, unchanged from Q1 (RTS). China’s factory activity unexpectedly dips as property pain persists (RTS). China Manufacturing Growth Fastest in Two Years, Survey Says — Exports-oriented Caixin gauge contrasts with weak official PMI, Results may offset some fears over cooling factory activity (BBG). China Raises Limit on Overseas Investment After 10-Month Pause (BBG).

- Japan’s business service prices rise at fastest annual pace since March 2015 (RTS). Ueda says Bank of Japan will proceed cautiously with inflation targeting frameworks (RTS). BOJ panelist calls for steady rate hikes, warns of inflation risk (RTS). Yen weakness persists despite Tokyo’s $62 billion intervention (RTS). Japan Post Goes Slow in Buying Longest Bonds After BOJ Rate Hike (BBG).

- Australia Raises Minimum Wage 3.75%, Aiding Inflation Fight (BBG). Australia home prices continue to climb, Sydney back at record high (RTS). RBA Sees Some Households Struggling, Suggesting Rate-Hike Limits (BBG). China Lifts Australian Beef Exporter Bans as Tensions Ease (BBG). Australia Has ‘Security Anxieties’ With China Even as Ties Warm (BBG).

EQUITIES

Global equities index stay in consolidation as last week’s low has held the prior March-April swing highs. Short-term heavy but picture remains mildly constructive.

Developed markets which covers all the major economies excluding US (Japan the highest country weight while the rest is heavily weighted to Europe) has carved out a solid holding pattern last week and Emerging market indices has put in a decent 5% pullback off the highs which should be good to monitor to see how those market perform from hereon and I suspect they will find a footing with US rates and dollar continuing to ease.

Japan and China equities look reasonably solid and without a meaningful risk-off trigger, I would not expect limited downside in these markets.

European equities also look reasonably solid, but overall momentum has slowed significantly to what could be the basis for topping signals. However the more strength resets as the action consolidates, the more I think its easier to argue for upside than it is down purely from a technical perspective.

Downside protection premiums have gotten elevated in the lead-up to PCE but has collapsed after. If NFP doesn’t produce any fireworks

COMMODITIES

Commodities have continued to correct so far this week and RSI as neutralised back to the 50 mid-point and

where Energy has been the major drag on the commodities complex.

Looking at Crude, I’m somewhat surprised that OPEC extending cuts has led to this breakdown and it’s clear it’s been more of a demand story than it has been supply in recent months. With China making some bigger steps towards recovery and Economic data not overly concerning, I think demand concerns may now be overplayed. Technically we have reached another critical price level for which the base was established at the beginning of the year.

I mentioned last week that NatGas pullback would be a great spot to look for an entry. It’s retraced further than I initially expected but after last week’s action, we’ve got better technical confirmation that the developing price action is a constructive one than just looking for ‘great levels’. Energy has taken quite the hit and I’m certainly more confident about taking longs at these levels than I was week ago.

CFTC managed money (mostly hedge funds) net interest for CL (Orange) and NG (Purple) is also looking more supportive for prices.

The correction in Copper is also now looking done with HG on course to print a Demark sequential 9-countdown. Should a rebound here coincide with a bounce in Crude, that would give me some confidence that demand or recession risks have been adequately priced and behind us.

RATES

Yields saw a nose dive last week roughly 30bps off the high at the beginning of the week. If that’s not encouraging for risk, perhaps this perspective could change your mind:

This is a spread of 10yr real yield vs 10yr inflation swap which is one thing I like to keep my eye on to see how tight real rates are relative to inflation expectations. Risk got a turbulent when this spread reached 6month highs in April (real rates almost equaling inflation expectations) just as we saw last October. We’ve carved out a lower high and low last week which says to me that we have a favourable trend for risk and there is no reason to expect further turbulence from the bond market.

CURRENCIES

FX markets have caught me off guard, most notably the CHF which I’ve been focused on fading strength. What I hadn’t anticipated was how much yields were going move on the PCE print (which I thought would have been well priced by the market after digesting PPI and CPI data) which was further compounded by other weaker economic data (a big negative change in monthly pending home sales and slowing PMI data).

The CHF index is beginning to look wildly overbought and as I’ve laid out my pro-risk case above, I think carry trades will find a period of strong performance again.

So this week in FX I turn my attention to AUDCHF and CADCHF (from GBPCHF) nibbling into a few positions in and around the BOC meeting. CAD shares my tactical view on Energy basing out as well as CAD having a lot of negativity priced in after a run of very soft economic data.

That’s it for now, good luck trading!